Get the free taxes tax form

Show details

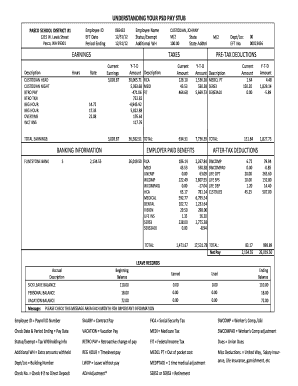

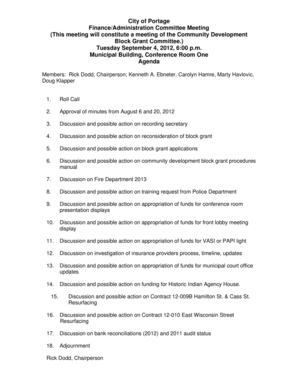

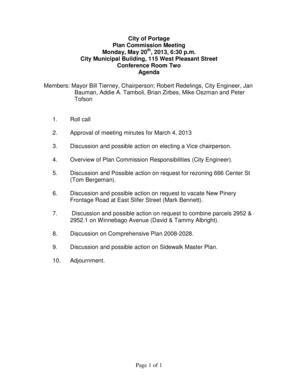

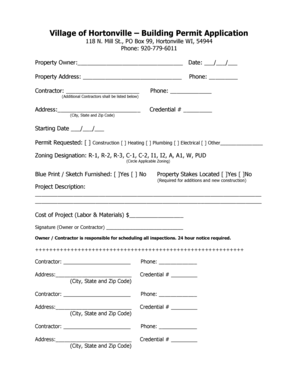

INCOMEDOCUMENT. com Make Download Create and Print Payroll Pay Check Stub Paystub 1099 w2 w-2 irs Income Document Online Here Free sample employee payslip template. Buy small business program United States -Free-Press-Release. com -Aug -www. INCOMEDOCS.com Print Paystubs w2 forms proof of income/employment HERE Work at Home Self employment paystub maker Small Business Self Employed Work at Home computer program Print w-2 1099 INSTANTLY free check stubs employees sample check stub employee...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your taxes tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxes tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxes tax online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxes self form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out taxes tax form

How to fill out taxes tax:

01

Gather all necessary documents such as W-2 forms, 1099s, receipts, and any other relevant financial documents.

02

Determine which tax forms you need to fill out based on your income level and sources of income. Common forms include the 1040, 1040A, or 1040EZ.

03

Fill out the personal information section of the tax form including your name, address, Social Security number, and any other requested details.

04

Report your income by entering the appropriate amounts in the designated sections of the tax form. Be sure to include all sources of income, such as wages, self-employment income, and investment income.

05

Deduct eligible expenses by reviewing the tax form's instructions and determining which deductions you qualify for. Some common deductions include mortgage interest, student loan interest, and medical expenses.

06

Calculate your tax liability by applying the appropriate tax rates to your taxable income. Consult the relevant tax tables or use tax software to simplify the calculation.

07

Determine if you qualify for any tax credits, such as the earned income tax credit or the child tax credit. These credits can help reduce your total tax liability.

08

Double-check all the information on your tax form for accuracy and completeness. Correct any errors or missing information before submitting.

09

Sign and date your tax form and attach any required schedules or forms.

10

Submit your tax return electronically or mail it to the designated tax agency by the tax deadline.

Who needs taxes tax:

01

Individuals with an income that exceeds a certain threshold are generally required to file taxes. The income threshold can vary depending on factors such as age, filing status, and type of income.

02

Self-employed individuals who earn above a certain amount must file taxes, regardless of whether they meet the standard income threshold.

03

Individuals who receive income from sources such as investments, rental properties, or freelance work are also typically required to file taxes.

04

Even if you are not required to file taxes, it may be beneficial to do so in order to claim certain credits or deductions that could result in a tax refund.

In summary, anyone with income above a certain threshold, self-employed individuals, and those with income from various sources typically need to file taxes. It is important to understand and follow the appropriate steps to fill out tax forms accurately and within the set deadline.

Fill paystub generator for self employed 1099 : Try Risk Free

People Also Ask about taxes tax

What is a tax withholding form?

What should I put on my tax withholding form?

What is a W-4 form used for?

What do I put on my withholding form?

Is it better to withhold taxes or not?

How do you decide how many withholdings should I claim?

What percentage should you withhold for taxes?

How many withholdings should I claim?

How do I fill out a tax withholding form to get more money?

Is it better to claim 1 or 0 on your taxes?

Is it better to claim 1 or 4?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is taxes tax?

Taxes Tax is a type of tax that is levied on businesses and individuals to fund government services. This type of tax is typically used to fund public services such as education, healthcare, infrastructure, and other public works. Taxes Tax may also be used to fund social services such as welfare, unemployment benefits, and other social programs.

What is the purpose of taxes tax?

Taxes are used to fund public services, infrastructure, and other government activities. They are also used to redistribute income and to regulate economic activity.

What information must be reported on taxes tax?

1. Income: All income must be reported on taxes, including wages, salary, tips, interest, capital gains, and other taxable income.

2. Deductions: Qualified deductions such as mortgage interest, charitable contributions, and medical expenses may be used to reduce taxable income.

3. Credits: Tax credits such as the child tax credit, earned income credit, and education credits may be used to reduce the amount of taxes owed.

4. Filing Status: Taxpayers must choose a filing status when filing their taxes, such as single, married filing jointly, or head of household.

5. Exemptions: Taxpayers may claim exemptions for themselves, as well as any dependents.

6. Payment: The amount of taxes owed must be paid by the due date.

When is the deadline to file taxes tax in 2023?

The deadline to file taxes in 2023 is April 18, 2023.

Who is required to file taxes tax?

Individuals who earn income above a certain threshold are required to file taxes. The specific income threshold varies based on factors such as filing status, age, and type of income. Generally, if an individual's income exceeds the standard deduction amount set by the IRS, they are required to file taxes. Additionally, individuals who have self-employment income, certain types of investment income, or receive certain types of income from other sources may also be required to file taxes. It is important to consult with a tax professional or refer to the IRS guidelines for specific requirements.

How to fill out taxes tax?

1. Gather all necessary documents: Gather your W-2 forms from your employer(s), any 1099 forms for additional income, a copy of last year's tax return, and any other relevant documents such as receipts for deductions or credits.

2. Determine your filing status: You must choose from one of five filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) with Dependent Child. Your filing status affects your tax rate and eligibility for certain credits and deductions.

3. Determine your exemptions: You need to determine the number of exemptions you are eligible to claim. This depends on your marital status, dependents, and other factors. The more exemptions you claim, the less tax will be withheld from your paycheck.

4. Calculate your income: Add up all income sources, including wages, self-employment income, dividends, interest, and any other income. Be sure to report all income accurately to avoid penalties for underreporting.

5. Gather deductions and credits: Gather any deductions or credits you may qualify for. This could include deductions for student loan interest, mortgage interest, medical expenses, or contributions to retirement accounts. Additionally, check if you qualify for any tax credits, such as the Child Tax Credit or Earned Income Tax Credit.

6. Choose your tax preparation method: There are multiple options for preparing your taxes, including using tax software, hiring a professional tax preparer, or filling out forms manually. Choose the method that best suits your needs and comfort level.

7. Fill out the necessary forms: If you are using tax software, it will guide you through the process of entering your information. If you are filling out forms manually, refer to the instructions provided for each form and fill them out accurately. Double-check all calculations and ensure that your information is entered correctly.

8. Review and submit your tax return: Once you have completed all necessary forms, review your tax return for any errors or missing information. Make sure you sign and date your return, attach all required documents, and mail it to the correct IRS address (if filing by mail) or e-file it using a secure method if filing online.

9. Pay any taxes owed: If you owe taxes, make sure to submit payment by the tax deadline to avoid penalties and interest. You can pay electronically, by mail, or through other approved payment methods.

10. Keep copies of your tax records: It is important to keep copies of all documents and forms you used to file your taxes. This includes your tax return, W-2 forms, 1099 forms, and any supporting documentation for deductions or credits.

What is the penalty for the late filing of taxes tax?

The penalty for late filing of taxes can vary based on several factors, including the country you reside in and the specific circumstances of your situation. However, in the United States, the penalty for late filing of federal taxes is usually calculated as a percentage of the unpaid taxes amount. As of 2021, the penalty is typically 5% of the unpaid taxes for each month or part of a month that the return is late, up to 25% of the unpaid tax amount. If you file your return more than 60 days after the due date, the minimum penalty can be either $435 or 100% of the unpaid tax, whichever is less. Keep in mind that these penalties can vary, and it is always advisable to consult with a tax professional or reference the official tax guidelines of your country for accurate and up-to-date information.

Can I create an electronic signature for the taxes tax in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit taxes self form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing taxes unemployment right away.

How do I fill out incomedocument w2 using my mobile device?

Use the pdfFiller mobile app to complete and sign taxes paid employer on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your taxes tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxes Unemployment is not the form you're looking for?Search for another form here.

Keywords relevant to incomedocument w2 printable form

Related to stubs sample payslip

If you believe that this page should be taken down, please follow our DMCA take down process

here

.